When you need to develop a specific price based on each client’s unique needs and perceived value of your services, you need more time to truly understand what services will benefit them most. While strategic planning in advance of the advisory work can initially slow down the onboarding process, it will pay off in the long run. Even after you’ve established your value pricing model, there’s a good chance you’ll need to adjust as you grow and become more accustomed to this new way of invoicing. This changing skill set allows firms to go beyond traditional compliance roles and become trusted advisors for clients — resulting in stronger client relationships and more fulfilling work.

Two Columbia accounting firms to merge – columbiabusinessreport.com

Two Columbia accounting firms to merge.

Posted: Mon, 07 Aug 2023 17:33:54 GMT [source]

Staying ahead of new financial reporting requirements can be difficult—particularly for companies that do not have in-house resources to address complex accounting and disclosure matters. We can help enhance your confidence in your business’ financial leadership through proactive, practical, and business-oriented insights. Ultimately, advisory services are all about guiding your clients to overcome their biggest problems and achieve their biggest goals. These are unique to every business and the intersection of their needs and your skills forms the basis of advisory. The reason clients seek out advisory services is because these are often things our clients cannot perform on their own.

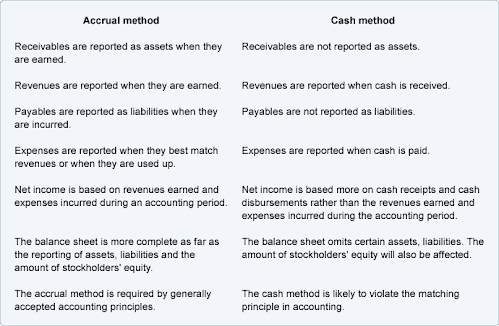

Accounting change

If your firm is their go-to for benefits planning, retirement planning, succession planning or other services, you become a lifeline for your clients. Your clients put down deep roots with you that they won’t want to pull up because they trust you to run so many aspects of their businesses. Keep reading to learn more about value pricing, how to approach new clients with your advisory offering, how to handle new advisory prospects, and more. The Practice Forward Graduate Master Learning Series is a CPE qualified, 6-session program presented by our Advisory Partners. This series is designed to advance your firm’s advisory journey and enhance your skills and knowledge in the field of advisory services. The latest advances in technology can also help you analyze trends and support your clients with meaningful insight that helps their businesses grow and thrive.

Practice Forward provides an essential blueprint for accounting firms to successfully transition from a transactional business model to one that is focused on delivering exceptional advisory services to their clients. A stable client base that produces year-round revenue ultimately puts your firm in a position to make more money by doing less work. But once they’re up and running, you’ll be able to spend less time courting clients and less time constantly looking for or trying to keep employees. Happier employees and stickier clients lead to better client service and deeper client relationships. By offering advisory services, your firm can become a strategic partner versus a compliance processer.

Once you have identified your target audience, it’s time to leverage the appropriate marketing channels. From digital marketing to social media, SEO, and email pushes, building a solid online presence will help you reach more prospects and demonstrate your knowledge. Even when clients come to you with a simple request, like “file my tax return” or “handle my payroll”, they often are looking for much more. “File my tax return” might actually mean “help me with tax strategy”.

Explore Financial Accounting Advisory Services

Our team has deep experience in these and other bankruptcy accounting and reporting issues. The short answer to this question is to shift away from Accounting advisory hourly billing to value-based pricing. With a value-based approach, your firm assigns a price based on the value your services bring to the client.

That may sound like wasted “free time” chatting with a client and fielding questions, but it wasn’t wasted at all. It was an essential piece of developing trust and understanding. At that moment, she didn’t need just accounting expertise, she needed me to be human.

How to start an advisory firm

DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. Regulatory, technical, and business complexities are driving finance and accounting teams to re-evaluate their policies, processes, controls, and systems. We can help your organization stay at the forefront of new financial reporting requirements. To price accounting advisory services appropriately, you must define the scope of work at the beginning of the project and ensure the client knows what is included and what will cost extra.

- Phil Ramacca, who held the title of President and Chief Operating Officer, will remain DLA’s President focusing on the firm’s strategy, mergers and acquisitions, human resources, finance and accounting, and business development.

- Look for new ways to build trust and let your clients know you’re there for them.

- From development stage startups to revenue-generating accelerated public company filers, Marcum has the breadth of experience to deal with the challenges companies face.

DLA, LLC (DLA), a leading provider of internal audit and accounting advisory services, announced the promotion of Keith Snyder to Chief Operating Officer. Phil Ramacca, who held the title of President and Chief Operating Officer, will remain DLA’s President focusing on the firm’s strategy, mergers and acquisitions, human resources, finance and accounting, and business development. There is a big difference between offering free advice and offering advisory services. But where do you draw the line between compliance work and accounting advisory? The answer lies in adopting a proven methodology, guidance, and content solutions that can help your firm develop and implement an advisory services approach to engaging clients.

Professional development & education

Open invitation to join virtual meetings hosted by a Practice Forward Consultant. You will have an opportunity to ask questions, share stories and ideas, and hear from other firms navigating their advisory journey. Get 1-on-1 individual coaching sessions with a dedicated consultant. Your consultant will provide support and guidance, share best practices and recommendations, and hold you accountable to reach your goals.

Consultants often don’t have the deeper, more personal knowledge of the client. I believe advisory services will be the future of accounting and bookkeeping for firms and solo practitioners. Another reason is that the pandemic has prompted business owners to become more concerned keeping their financials current as they closely monitor cash flow or apply for government subsidies. Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges they’re facing. If you’re a leader within an accounting firm, you’ve likely heard of advisory services and their lucrative impact.

Friday Footnotes: Accountants Are Into AI; KPMG Atlanta MP on ICE T; 150 Hour Inequity 8.18.23 – Going Concern

Friday Footnotes: Accountants Are Into AI; KPMG Atlanta MP on ICE T; 150 Hour Inequity 8.18.23.

Posted: Fri, 18 Aug 2023 21:00:46 GMT [source]

This shift not only increases revenue but positively impacts your clients’ business and financial lives—and opens the door to more meaningful work for you and your staff. Another way to improve your advisory services is to adopt a client-centric approach. This means that you focus on understanding and meeting the needs, preferences, and expectations of your clients.

What is your target market’s age, profession, income level, and so on? Do you currently serve a particular industry or niche, like mergers and acquisitions? When you understand your audience, you can develop a marketing campaign with messages that truly resonate.

Our team can help ensure that you’re clear on the implications, and that you know your obligations and are ready to meet them. At the end of the day, value-based pricing rewards your firm and employees for their expertise and efficiency—and results in higher margins and happier clients. Another benefit of using Practice Forward is that it enables you to communicate with your clients more effectively and efficiently. You can create secure client portals where you can share documents, messages, invoices, and feedback.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. © 2023 Copyright owned by one or more of the KPMG International entities.

How Do We Obtain an Extension of Time for Filing Form 5500?

When a client needs personalized attention and expertise on-demand, we deliver. Every positive engagement is the result of mutual trust, strong relationships, and close collaboration. Our clients know that we are fully dedicated to their success and always have their best interests in mind.

Clients already trust you with all of their most important data. Chances are they would love to have you do more than just their taxes. They don’t want to have to deal with multiple contractors or providers.

With a scope agreement in place, your firm can kick off an advisory engagement with the right expectations in place and ensure they are understood from the beginning. If a client comes to you with a question that goes beyond the scope of their tax return, put your radar up. There’s an unmet need there—and it’s an opening into a new relationship you can’t afford to overlook.